The countries that are the first to dramatically go down (Iceland, Pakistan, Eastern Europe, etc.) in the financial crisis, and the ones that are soon to follow them (Turkey, South Africa, etc.), are the very ones where the Washington Consensus has had the strongest impact. The more pro-American you are, the worse off you will be.* If the IMF doesn't want to send that message to the world, it can attach fewer anti-working-class (and dangerously pro-cyclical) conditions to its bailout packages, especially for the ones in the former Soviet sphere of influence, but, if this AP dispatch about the Ukraine deal is any indication, it looks as if the only country that gets a lot of special political considerations may be Georgia: Associated Press, "Yatsenyuk: Parliament Will Adopt Unpopular Conditions in Exchange for IMF Aid," Kyiv Post, 28 October 2008).

* In contrast, "Financial Crisis Leaves Iran Untouched" (Al Jazeera, 8 Oct 2008):

See, also, "Iran and the Financial Crisis" (Al Alam TV, 7 October 2008):

Tuesday, October 28, 2008

Friday, October 17, 2008

Marx on the National Debt

The only part of the so-called national wealth that actually enters into the collective possessions of modern peoples is their national debt. Hence, as a necessary consequence, the modern doctrine that a nation becomes the richer the more deeply it is in debt. Public credit becomes the credo of capital. And with the rise of national debt-making, want of faith in the national debt takes the place of the blasphemy against the Holy Ghost, which may not be forgiven. -- Karl Marx, Capital

Monday, October 13, 2008

Multinational Investors' Vote of Confidence in Ultra-imperialism

Check out multinational investors' major vote of confidence in ultra-imperialism today: John Willman, "Markets Cheer Bank Bail-outs" (Financial Times, 13 October 2008); Ralph Atkins, "European Banks Offer Unlimited Dollar Funding" (Financial Times, 13 October 2008); "Full Text: US Treasury Tarp Plans" (Financial Times, 13 October 2008); Louise Story and Andrew Ross Sorkin, "Morgan Agrees to Revise Terms of Mitsubishi Deal" (New York Times, 13 October 2008); "Gulf Shares Surge as UAE and Qatar Act (Financial Times, 12 October 2008); and Robin Wigglesworth and Simeon Kerr, "UAE Leads Drive to Stem Crisis" (Financial Times, 13 October 2008).

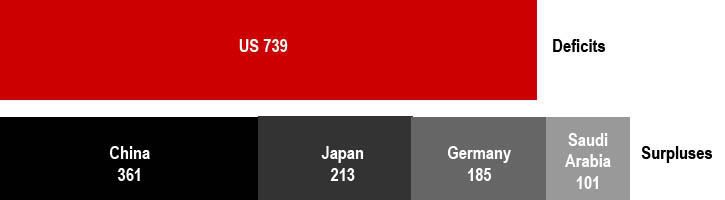

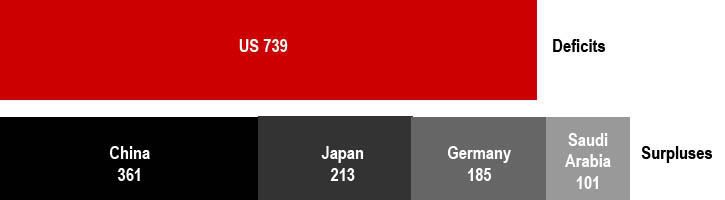

It's true that, if China, Japan, Germany, Saudi Arabia, and the United States functioned as one politically (if not legally) coherent establishment, Americans would be back in the black:

Therefore, a radical shift in global class relations could come only if there were a radical shift in any one of the aforementioned countries, but these are the very ones where the Left has the least chance in the world.

Is China, though, a weak or strong link in this chain of empire (to which Latin socialists, Islamists from the Hindu Kush to the Persian Gulf to the Horn of Africa to the Niger Delta, Maoists in Nepal and India, the national security interests of Russia, etc. have provided a partial material -- if ideologically incoherent -- counterweight)?

Update

"[T]he needs of our economy require that our financial institutions not take this new capital to hoard it, but to deploy it" ("Text: Henry Paulson Remarks Tuesday," 15 October 2008).

"Investors are recognizing that the financial crisis is not the fundamental problem. It has merely amplified economic ailments that are now intensifying: vanishing paychecks, falling home prices and diminished spending. And there is no relief in sight" (Peter S. Goodman, "Markets Suffer as Investors Weigh Relentless Trouble," New York Times, 16 October 2008).

It's true that, if China, Japan, Germany, Saudi Arabia, and the United States functioned as one politically (if not legally) coherent establishment, Americans would be back in the black:

Global Balance of Payments ($bn, 2007)

SOURCE: Martin Wolf, "Asia's Revenge," Financial Times, 9 October 2008, p. 9.

Therefore, a radical shift in global class relations could come only if there were a radical shift in any one of the aforementioned countries, but these are the very ones where the Left has the least chance in the world.

Is China, though, a weak or strong link in this chain of empire (to which Latin socialists, Islamists from the Hindu Kush to the Persian Gulf to the Horn of Africa to the Niger Delta, Maoists in Nepal and India, the national security interests of Russia, etc. have provided a partial material -- if ideologically incoherent -- counterweight)?

Update

"[T]he needs of our economy require that our financial institutions not take this new capital to hoard it, but to deploy it" ("Text: Henry Paulson Remarks Tuesday," 15 October 2008).

"Investors are recognizing that the financial crisis is not the fundamental problem. It has merely amplified economic ailments that are now intensifying: vanishing paychecks, falling home prices and diminished spending. And there is no relief in sight" (Peter S. Goodman, "Markets Suffer as Investors Weigh Relentless Trouble," New York Times, 16 October 2008).

Sunday, October 12, 2008

Toward the Highest Stage of Ultra-imperialism?

A local friend of mine jokes: if worst comes to worst, the US can always annex Saudi Arabia. But why stop there on the way to the highest stage of ultra-imperialism: America, China, Japan, Germany, and Saudi Arabia together legally conglomerated into a new United States, bringing Americans -- thank Allah and Confucius -- back in the black?

Global Balance of Payments ($bn, 2007)

SOURCE: Martin Wolf, "Asia's Revenge," Financial Times, 9 October 2008, p. 9.

What lay behind the savings glut? The first development was the shift of emerging economies into a large surplus of savings over investment. Within the emerging economies, the big shifts were in Asia and in the oil exporting countries (see chart). By 2007, according to the International Monetary Fund, the aggregate savings surpluses of these two groups of countries had reached around 2 per cent of world output.There is no political or economic incentive on the part of the biggest deficit spenders, especially the US, to change this pattern. The change therefore has to come from surplus generators.

. . . . . . . . . . . . . . . . . . . .

Last year, the aggregate surpluses of the world's surplus countries reached $1,680bn, according to the IMF. The top 10 (China, Japan, Germany, Saudi Arabia, Russia, Switzerland, Norway, Kuwait, the Netherlands and the United Arab Emirates) generated more than 70 per cent of this total. The surpluses of the top 10 countries represented at least 8 per cent of their aggregate GDP and about one-quarter of their aggregate gross savings.

Meanwhile, the huge US deficit absorbed 44 per cent of this total. The US, UK, Spain and Australia -- four countries with housing bubbles -- absorbed 63 per cent of the world's current account surpluses.

That represented a vast shift of capital – but unlike in the 1970s and early 1980s, it went to some of the world's richest countries. (emphasis added, Wolf, p. 9)

Thursday, October 09, 2008

The Global Financial Crisis Has a Social Cause, Too: the World of Low Wages: An Interview with Emiliano Brancaccio

The Global Financial Crisis Has a Social Cause, Too: the World of Low Wages:

An Interview with Emiliano Brancaccio

by Waldemar Bolze

Emiliano Brancaccio is a professor of labor economics at the University of Sannio, member of Rifondazione Comunista, and advisor to the largest union of Italian metalworkers FIOM-CGIL.

You maintain that the financial crisis is not purely a technical financial phenomenon but has a social cause. Why?

The starting point is the weakness of the labor movement, which has made a world of low wages possible. However, this world is structurally unstable, which we are now beginning to experience. Today every country tries to keep the wage level low, thereby diminishing the domestic demand, and must find foreign markets for its own products.

This mechanism has worked for the last ten years because the United States has functioned as a "vacuum cleaner" for surplus products of other countries. And not because the wages of American workers were so high, but because a huge private debt was accumulated in the United States. The system led to workers paying their mortgage debts with new loans and paying the interests on the loans with new credit cards.

Could such a fragile credit structure actually hold?

It was nothing other than a time bomb, which has now exploded. The consequences are once again passed onto workers and employees, while executives of Wall Street, who manufactured these explosives, could even profit from them.

Take, for example, the Paulson plan. It stipulates that the government is to buy the risky assets of investment banks and in return place fresh money at their disposal, leaving a possibility that the banks, once the storm has passed, can regain their titles. If the government pays high enough prices, the bankers can eventually pocket a nice profit at the expense of the state budget.

What obvious impact will the current crisis have?

Much will depend on its duration and depth. At the moment, the establishment is pursuing a strategy which Giuseppe Tomasi di Lampedusa spelled out in his book The Leopard: "If we want everything to remain as it is, we must change everything." The Paulson plan is an example of this strategy, because it consists of a barter of cash for debts, designed to intervene as little as possible in the terms of ownership and control of bank capital. The same applies to the sales of preferred shares to the government because these restrict the voting right at the meetings of shareholders.

Has the ideology of neoliberalism failed and are the days of capitalism numbered?

The idea is amusing, but it would be naïve to assume an imminent end of capitalism. I cannot see how such a thing can materialize. The big absentee in this colossal state of emergency is precisely the labor movement. Rather, I see the possibility of a shift in relative power from finance lobbies to political pressure groups and also from Western and American political lobbies to Asian ones.

Can we then speak of the decline of the American empire?

The appearance and all temporary upsurges and short-term successes notwithstanding, the American decline has continued for at least a quarter century. For this decline is symptomatic of the long-term development of the dollar, whose price -- converted to today's currency -- has fallen from 1.50 euros to around 70 euro cents within 20 years. This decline ensures distrust toward the dollar and will likely prevent the USA from playing the role of the "vacuum cleaner" for surplus products of other countries again. Since there is no alternative international hegemon, there is a danger that the international monetary system will hit a dead end. In that event, the development of this crisis could take on really dark and unpredictable characteristics.

The original interview in German appeared in junge Welt on 9 October 2008. Translation by Yoshie Furuhashi.

An Interview with Emiliano Brancaccio

by Waldemar Bolze

Emiliano Brancaccio is a professor of labor economics at the University of Sannio, member of Rifondazione Comunista, and advisor to the largest union of Italian metalworkers FIOM-CGIL.

You maintain that the financial crisis is not purely a technical financial phenomenon but has a social cause. Why?

The starting point is the weakness of the labor movement, which has made a world of low wages possible. However, this world is structurally unstable, which we are now beginning to experience. Today every country tries to keep the wage level low, thereby diminishing the domestic demand, and must find foreign markets for its own products.

This mechanism has worked for the last ten years because the United States has functioned as a "vacuum cleaner" for surplus products of other countries. And not because the wages of American workers were so high, but because a huge private debt was accumulated in the United States. The system led to workers paying their mortgage debts with new loans and paying the interests on the loans with new credit cards.

Could such a fragile credit structure actually hold?

It was nothing other than a time bomb, which has now exploded. The consequences are once again passed onto workers and employees, while executives of Wall Street, who manufactured these explosives, could even profit from them.

Take, for example, the Paulson plan. It stipulates that the government is to buy the risky assets of investment banks and in return place fresh money at their disposal, leaving a possibility that the banks, once the storm has passed, can regain their titles. If the government pays high enough prices, the bankers can eventually pocket a nice profit at the expense of the state budget.

What obvious impact will the current crisis have?

Much will depend on its duration and depth. At the moment, the establishment is pursuing a strategy which Giuseppe Tomasi di Lampedusa spelled out in his book The Leopard: "If we want everything to remain as it is, we must change everything." The Paulson plan is an example of this strategy, because it consists of a barter of cash for debts, designed to intervene as little as possible in the terms of ownership and control of bank capital. The same applies to the sales of preferred shares to the government because these restrict the voting right at the meetings of shareholders.

Has the ideology of neoliberalism failed and are the days of capitalism numbered?

The idea is amusing, but it would be naïve to assume an imminent end of capitalism. I cannot see how such a thing can materialize. The big absentee in this colossal state of emergency is precisely the labor movement. Rather, I see the possibility of a shift in relative power from finance lobbies to political pressure groups and also from Western and American political lobbies to Asian ones.

Can we then speak of the decline of the American empire?

The appearance and all temporary upsurges and short-term successes notwithstanding, the American decline has continued for at least a quarter century. For this decline is symptomatic of the long-term development of the dollar, whose price -- converted to today's currency -- has fallen from 1.50 euros to around 70 euro cents within 20 years. This decline ensures distrust toward the dollar and will likely prevent the USA from playing the role of the "vacuum cleaner" for surplus products of other countries again. Since there is no alternative international hegemon, there is a danger that the international monetary system will hit a dead end. In that event, the development of this crisis could take on really dark and unpredictable characteristics.

The original interview in German appeared in junge Welt on 9 October 2008. Translation by Yoshie Furuhashi.

Saturday, October 04, 2008

History

Once upon a time, the Left believed that history was on the march toward socialism. This belief has been shaken by various events, from the Moscow show trials, Hungary 1956, Czechoslovakia 1968, to the end of the USSR and restoration of capitalism in China.

Once upon a time, the Right believed, like Francis Fukuyama, that history had ended, with the culmination of history in capitalism + liberal democracy. This belief has been shaken by various events: Islamic resistance to the West's politico-military campaign to create a New Middle East, a resurgence of the Left in Latin America, the West's self-destruction of its own liberal and democratic facade through the "War on Terror," and finally the global financial crisis starting in the subprime states of America.

Now both sides have to approach history as an open-ended process of struggle.

Once upon a time, the Right believed, like Francis Fukuyama, that history had ended, with the culmination of history in capitalism + liberal democracy. This belief has been shaken by various events: Islamic resistance to the West's politico-military campaign to create a New Middle East, a resurgence of the Left in Latin America, the West's self-destruction of its own liberal and democratic facade through the "War on Terror," and finally the global financial crisis starting in the subprime states of America.

Now both sides have to approach history as an open-ended process of struggle.

Six Weeks

After having threatened Americans with a great depression if their representatives don't vote for the $700 billion bailout NOW, it turns out that the Treasury won't be able to BEGIN to put it into action for SIX WEEKS. In normal course, the market reacts more negatively to a left-wing program than a right-wing one like this, but this financial crisis is probably an exception.

Friday, October 03, 2008

The Market Value of Islam Going Up?

At any other time at least since 11 September 2001 (if not 4 November 1979), well-financed propaganda like Obsession ("a documentary [sic] about 'radical Islam’s war against the West'"), combined with general hatred of immigrants, would have become big news and a not insignificant factor in not just elections but politics in general in the USA.

But I take comfort in the thought that even the dimmest bulbs in the middle of Middle America must be too appalled by the financial crisis to obsess over Muslims.

As a matter of fact, the market value of Islam might even be going up just now among the financially insecure: Syed Zahid Ahmad, "Islamic Banking Restrains Bankruptcy" (RGE, 28 September 2008); Mohammed Al-Hamzani, "Islamic Banks Unaffected by Global Financial Crisis" (Asharq Al-Awsat, 30 September 2008); "Non-Muslims Turn to Islamic Bank as a Safe Option" (Birmingham Post, 3 October 2008).

But I take comfort in the thought that even the dimmest bulbs in the middle of Middle America must be too appalled by the financial crisis to obsess over Muslims.

As a matter of fact, the market value of Islam might even be going up just now among the financially insecure: Syed Zahid Ahmad, "Islamic Banking Restrains Bankruptcy" (RGE, 28 September 2008); Mohammed Al-Hamzani, "Islamic Banks Unaffected by Global Financial Crisis" (Asharq Al-Awsat, 30 September 2008); "Non-Muslims Turn to Islamic Bank as a Safe Option" (Birmingham Post, 3 October 2008).

Thursday, October 02, 2008

Poverty of Crisis Debate

Leftists, especially Marxists, are fond of debates on crises. But our debates have often revolved around questions that are not exactly helpful to people in crisis. We tend to debate such questions as:

What are the underlying causes of crisis -- overaccumulation, overproduction, underconsumption, or what?

But the question that we should have been really debating, learning from historical examples, is: in case of a crisis, how do we counter a financial blackmail of capital (e.g., if you don't give us $700 billion, we'll commit suicide bombing and take you all down)? As long as we capitulate to this blackmail and seek a solution on capital's terms, we'll remain social democrats.

What are the underlying causes of crisis -- overaccumulation, overproduction, underconsumption, or what?

But the question that we should have been really debating, learning from historical examples, is: in case of a crisis, how do we counter a financial blackmail of capital (e.g., if you don't give us $700 billion, we'll commit suicide bombing and take you all down)? As long as we capitulate to this blackmail and seek a solution on capital's terms, we'll remain social democrats.

Subscribe to:

Posts (Atom)